Understanding Financial Health Beyond the Numbers

Most businesses track revenue and expenses. But can you survive a rough quarter? Would you spot trouble before it becomes critical? Liquidity and solvency analysis answers these questions. We teach you how to read what your balance sheet is actually telling you about your company's future.

Explore Our Program

The Framework That Actually Makes Sense

Financial analysis doesn't have to feel like decoding ancient hieroglyphics. We break down liquidity and solvency into three practical pillars that anyone running a business can understand and apply.

Short-Term Reality Check

Can you pay your bills next month? Current ratio, quick ratio, and cash flow analysis show whether you have enough liquid assets to cover immediate obligations. This isn't theoretical—it's about keeping the lights on.

Long-Term Sustainability

Solvency looks at whether your business can survive beyond this year. Debt-to-equity ratios, interest coverage, and capital structure reveal if you're building on solid ground or a foundation of borrowed time.

Operational Efficiency

How quickly does inventory turn into cash? Are customers paying on time? Working capital management directly impacts both liquidity and profitability. Small improvements here can prevent big crises later.

Real Situations We Cover in Detail

When Growth Becomes Dangerous

You're landing bigger clients. Revenue is up 40%. Sounds great, right? Then why is your bank account emptying? We examine growth-induced liquidity crunches and show you warning signs before cash flow problems derail momentum.

Seasonal Business Survival

Retail, tourism, agriculture—many industries face predictable dry spells. How do you structure financing to bridge lean months? What reserves should you maintain? We walk through actual case studies from Australian businesses navigating seasonal challenges.

Debt Isn't Always Bad

Some business owners fear all borrowing. Others leverage themselves into corners. The truth lies somewhere in between. Understanding when debt accelerates growth versus when it threatens survival makes all the difference.

How You'll Actually Learn This Stuff

Forget passive lectures and generic textbook examples. Our program centers on interactive analysis of real financial statements, case discussions, and building your own assessment frameworks.

Live Statement Analysis

Work through anonymized financial statements from actual Australian companies. Identify red flags, calculate key ratios, and present your findings.

Industry Comparisons

What's considered healthy liquidity in manufacturing versus professional services? Context matters. We examine benchmarks across different sectors.

Crisis Simulation

Your biggest customer just declared bankruptcy. How does this impact your liquidity position? What actions do you take first? Scenario planning prepares you for reality.

Who's Teaching This Program

Our instructors aren't just academics. They've worked through actual business crises, restructured troubled companies, and advised boards during financial turnarounds.

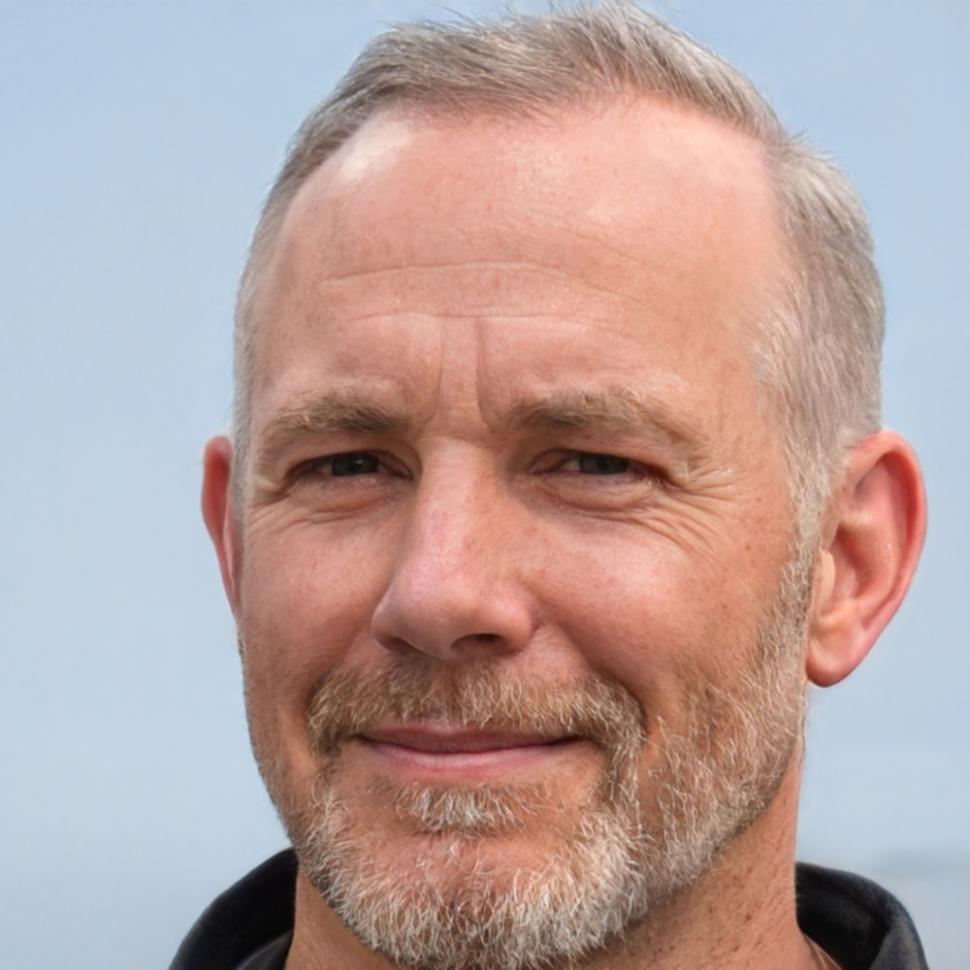

Rory Blackwood

Corporate Finance SpecialistSpent twelve years as CFO for mid-market manufacturing companies. Rory has personally navigated three recessions, two industry downturns, and one near-bankruptcy turnaround. He teaches what actually works when theory meets messy reality.

Freja Lindstrom

Credit Risk AnalystBefore teaching, Freja evaluated loan applications for commercial clients at major Australian banks. She's reviewed thousands of financial statements and knows exactly what lenders look for when assessing business health.

Next Program Starts September 2025

Classes run Tuesday and Thursday evenings for eight weeks. Whether you're a business owner, aspiring CFO, or just want to understand financial statements properly, this program gives you practical analytical skills.